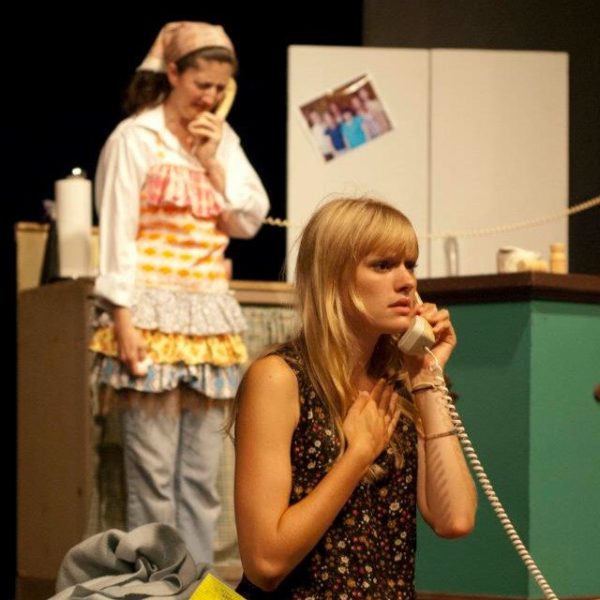

Your Gift Makes a Difference

Help Chagrin Valley Little Theatre reach a Century of Entertainment

As always, we are dedicated to bringing the community the best in live theater and education with quality shows, outstanding actors and talented directors at a reasonable price. To make this happen, we rely on support from people like you.

We hope that you will support us by making a tax-deductible donation to the Chagrin Valley Little Theatre, an Ohio 501(c)(3) arts non-profit. We also hope you will consider including us in your philanthropic planning.

You can make a donation right now using our secure 'Arts People' online portal or call our Box Office at (440) 247-8955 for other arrangements. Donors in all amounts are recognized with a listing in our playbills.

Charitable IRA Distribution

You can make a tax-free gift from your traditional IRA. Such a gift is known as a “Qualified Charitable Distribution” or QCD. They are easy to make and there are benefits to you for doing so!

The QCD Basics

- You must be at least 70 ½ years old to take advantage of this opportunity.

- Your QCD must go directly from your IRA administrator to Chagrin Valley Little Theatre. (Other retirement plans such as 401(k)s and 403(b)s are not eligible.)

- Check with your IRA administrator or financial advisor about applicable QCD limits for the current tax year.

Why make a QCD gift?

- If you don’t itemize and are not yet required to take your Required Minimum Distribution (RMD), a QCD offers all of the benefits of an itemized income tax charitable deduction.

- If you are age 73 and must take your Required Minimum Distribution (RMD), a QCD can satisfy your RMD without increasing your income taxes.

- Your gift supports the important work of Chagrin Valley Little Theatre with a tax-free gift.

Include CVLT in Your Estate Plans

You can make a lasting difference to CVLT while lowering your tax burden by including CVLT in your estate plans. The easiest ways to do this are via a bequest or beneficiary designation as described below. Please don’t forget to notify us if you choose to do so!

Beneficiary Designation

Beneficiary designation is one of the simplest ways to make a gift to Chagrin Valley Little Theatre. It’s literally as easy as filling out a form. You can specify a percentage or an exact dollar amount of assets held in a retirement account, life insurance policy, or other bank account or commercial annuity contract.

To make a beneficiary designation, contact your retirement / bank account / insurance administrator and indicate that you wish to make Chagrin Valley Little Theatre the beneficiary of a specified amount or percentage. Your administrator will have you complete a simple form. You will need CVLT’s Federal ID, which is 23-7150715.

Making a Bequest

A charitable gift from your estate is a favored method of giving that enables you to achieve your financial goals and benefit Chagrin Valley Little Theatre. No other planned gift is as simple to make or as easy to change should you ever need the assets during your lifetime.

In order to avoid any possible question that your bequest is to our organization, be sure to include our full legal name and our federal tax identification number in your bequest:

Chagrin Valley Little Theatre

40 River Street

Chagrin Falls OH 44022

Federal Tax ID: 23-7150715

An example of a General Bequest to CVLT could be worded in your Will or Trust documents as follows:

I give to Chagrin Valley Little Theatre, 40 River Street, Chagrin Falls OH 44022, an Ohio nonprofit corporation, or its successor, Federal Tax Identification Number 23-7150715 [insert the exact dollar amount or percentage here].